This article is highly biased and misleading imo.

First of all, it doesn’t make sense to compare economic policy performance by a single metric, be it inflation or GDP or anything else, let alone if you compare economies in different periods.

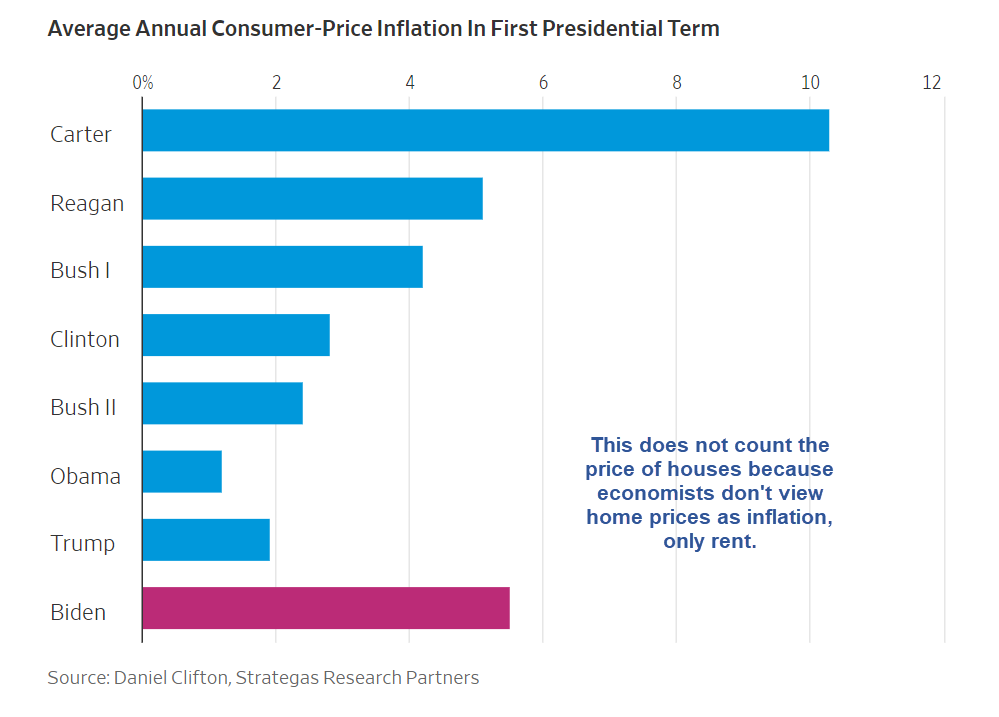

For example, the high inflation during president Carter’s term was mainly due to the oil crisis in the 1970s. President Biden started his term in 2020 - right when the pandemic broke out and subsequent interruptions of global supply chain caused a soaring inflation. You may or may not agree with both presidents’ economic policies, but you can’t obviously blame Carter or Biden for the oil crises and the pandemic, respectively.

The articles also says:

Neither the Fed nor economists in general view housing prices as inflation. The economic illiterates do not count asset prices in general as inflation.

The ‘economic illiterates’ use inflation to measure prices of consumer goods and services but explicitly not to measure prices of assets. This is why rent can reasonably be part of such an index, but house prices probably not (exactly because a house is an asset and not a consumer good). This is also one reason why you should always look at a dashboard of metrics and interpret them to the individual circumstances (e.g., in different epoches, cultures, etc.) rather than looking at just one measurement.

So the inflation and the way how it is measured (there are multiple ways to do so) is certainly an imperfect metric, but this is true for any metric. And comparing the economic policies over several decades by just using a single metric doesn’t make any sense.

(Edit typo.)