Fuckin paywall

Here you go:

Congress just cut IRS funding. It costs even more than we thought. Catherine Rampell, Youyou Zhou 8–11 minutes

The White House and Congress recently agreed to claw back more than $20 billion earmarked for the Internal Revenue Service. This deal was, ostensibly, part of a grand bargain to reduce budget deficits.

Unfortunately, it’s likely to have the opposite effect. Every dollar available for auditing taxpayers generates many times that amount for government coffers — and the rate of return is especially astonishing for audits of the wealthiest Americans, according to new research shared exclusively with The Post.

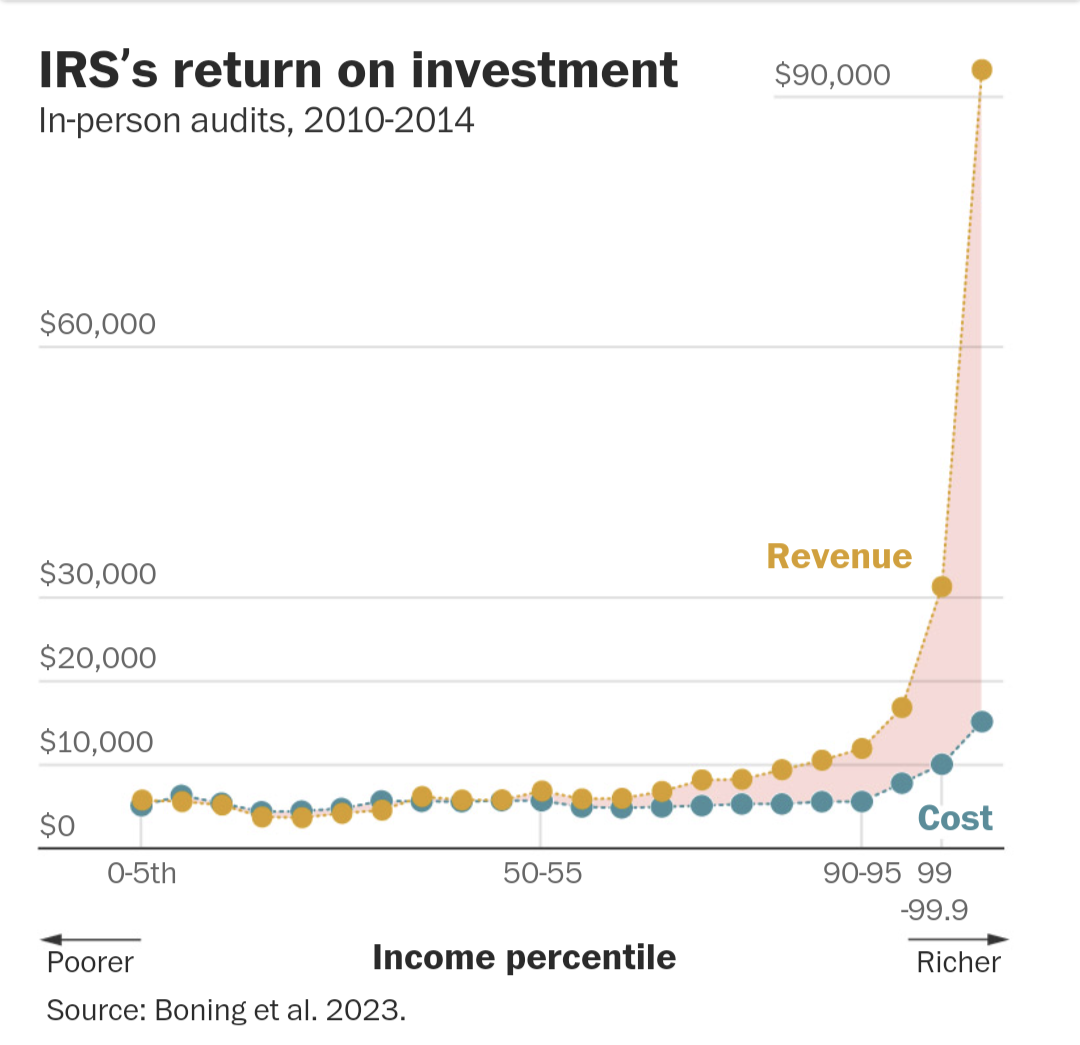

A team of researchers at Harvard University, the University of Sydney and the Treasury Department examined internal IRS data for approximately 710,000 in-person audits from 2010 to 2014. Here’s what they found:

This chart shows that for each dollar spent, the IRS makes $0.96 for auditing the bottom half of population by income percentile.

This chart shows that for each dollar spent, IRS makes $3.18 for auditing the top 1 percent of the population by income distribution

Wealthy people generally have more complex tax returns, so auditing them costs more. Internal government records show that the IRS employees auditing the rich earn higher wages and spend much more time per audit; overhead costs add up, too.

Now here’s the revenue collected per audit, from additional taxes, penalties and interest. The differential for low- vs. high-income taxpayers is even bigger.

This means that while the upfront costs of auditing the wealthy are usually higher — perhaps suggesting these taxpayers aren’t worth going after — the average return on investment is much better.

Another way to think about this: On average, the direct revenue collected from audits exceed costs by a factor of 2 to 1. But, that payoff varies by income. For money spent auditing the bottom half of taxpayers, the IRS only roughly broke even.

Meanwhile, the agency pulled in $3.18 for each dollar spent auditing the top 1 percent, and $6.29 for the top 0.1 percent.

These figures take into account any agency resources spent on appeals, collections, etc., as well as the fact that some lucky taxpayers ended up owing no additional money after the audit process was completed.

And even those eye-popping numbers understate how much money we’re leaving on the table by not fully enforcing tax law. That’s because the biggest bang for the buck comes from what happens well after the audit concludes.

In the years after a taxpayer gets audited, they start paying much more in taxes voluntarily. Maybe, post-audit, they stop taking some dodgy deductions (counting a personal car as a business expense, for example). Or they start reporting income they had previously accepted off the books.

These kinds of changes might happen because the taxpayer in question had previously made an honest mistake. Then again, maybe they had been deliberately cheating Uncle Sam, and were chastened by being caught.

Either way: they begin paying more of what they owe.

These additional taxes equal about three times the revenue raised from the initial audit, on average, over the 14 years of data the researchers had access to. So in other words, the biggest returns from doing more audits come from deterrence effects. (That’s why, incidentally, the IRS has historically publicized its big tax fraud cases in the weeks before Tax Day, when most Americans are filing their returns.)

That multiplier — three times as much revenue from deterrence effects as from the initial audit — is relatively consistent across the income distribution, with both rich and poor adjusting their post-audit tax habits significantly. Which still means that in raw dollar terms auditing the rich has bigger payoffs.

The return on investment appears even higher if you home in on just the tippy-top of the income distribution (say, the top 1 percent or 0.1 percent), but the authors say they are less confident about estimating the deterrence effects for that smaller slice of the population. Consequences of the deal to claw back money from the IRS

So what do these numbers tell us about Congress’s decision to claw back money from the IRS? They suggest that existing projections for long-term costs likely underestimate the massive hole this policy will blow into federal budgets.

Usually the Congressional Budget Office (among other scorekeepers) assumes relatively modest effects on voluntary compliance from ramping up IRS enforcement. Again, the authors instead find the opposite, that the long-term deterrence effects are huge, much larger than the upfront bounty that comes from the audits themselves. Senate Minority Leader Mitch McConnell (Ky.), House Speaker Kevin McCarthy (Calif.) and Senate Majority Leader Sen. Charles E. Schumer (N.Y.) listen to President Biden at the White House on May 9. (Evan Vucci/AP)

What’s more, budget analysts usually assume that each additional dollar you give to IRS enforcement will have a little less bang for the buck than most of the dollars spent before it — that is, IRS agents have probably already gone after all the low-hanging fruit, and whatever additional audits they do will have smaller and smaller payoffs. Economists refer to this phenomenon as “diminishing marginal returns.”

This team of researchers determined that this conventional wisdom is likely wrong, too.

They looked at the consequences of the huge cuts to the IRS’s enforcement budget that began in 2010. Audit rates plummeted (by about 40 percent overall, within four years), but the agency did not cut back on the audits with the lowest ROI. Instead, for whatever reason, it cut a lot of the highest bang-for-the-buck audits. Based on the agency’s past prioritization of audits, and the way its internal costs are structured, the authors found no evidence of diminishing marginal returns.

For every additional dollar spent auditing people in the top decile of the income distribution, the government can expect to get 12 times that amount back.

Twelve! As any tax-dodging billionaire can attest: It’s pretty hard to beat that return on investment.

In other words: If the IRS spends more money on audits, and those resources actually target high earners, the payoff could be enormous — far greater than has usually been assumed.

Now, it’s reasonable to worry that a newly flush IRS might not actually concentrate its additional dollars on the highest-ROI audits. Audits of millionaires (and megacorporations) have dramatically declined in recent years, according to data from Syracuse University’s Transactional Records Access Clearinghouse.

Certainly Republicans have fearmongered that the IRS will devote all its new money to deploying “armies” of gun-toting IRS agents to hound honest, middle-class taxpayers. So what evidence do we have that the agency will pursue higher-earning, higher-ROI tax-shirkers instead?

For one, President Biden, Treasury Secretary Janet L. Yellen and others have pledged to raise audit rates only on households earning more than $400,000 (which is close to the top percentile, in this study’s data). Two, the agency is now equipped with better information about how to spend its dollars most efficiently, thanks to this new research.

“The evidence suggests going after higher-income taxpayers has higher returns, and that’s reassuring given the recent policy focus on auditing wealthy individuals,” says Ben Sprung-Keyser, one of the study’s co-authors and a co-director at Policy Impacts, a research organization based at Harvard that promotes standardization in policy analysis. He and his colleagues also found that auditing top earners raises revenue more efficiently than does increasing their tax rates.

Press Enter to skip to end of carousel Opinions on business and economics

Carousel - $Opinions on business and economics: use tab or arrows to navigate

End of carousel

Which means rather than soaking the rich through higher tax rates, perhaps we should merely enforce existing law.

In any case, the revenue Congress just agreed to leave on the table by rescinding $20 billion from IRS’s long-term budget could be substantial. Based on that 12 to 1 multiplier found in this study for marginal returns from auditing high earners, that could mean Congress just gave up about $240 billion in revenue, for a net cost to the budget of $220 billion ($240 billion - $20 billion cut from IRS budget = $220 billion).

So much for trying to reduce deficits.

Install the browser plugin “Bypass Paywalls Clean”

Yup. Trying to bankrupt the government so they can state that they need to start cutting critical services.

Please cross post to US news subs

Smart enough to set up a Lemmy instance, too dumb to read financial graphs. Can anyone help someone dumb with money? :)

The IRS generates many times more revenue than its operating cost when they audit wealthy taxpayers.

Meanwhile, they are now requiring people to disclose even $600/yr income gained from side sources. This is down from the previous requirement of mandating it only if one earn $20,000/yr from side sources.

If they only intend to audit the big guys, why are they suddenly requiring people to report a measly $600/yr in side-income while simultaneously massively beefing up the number of auditors?

Independent contractors have loosely had the same $600 threshold for a long time (you’re supposed to report all income, but the payer is required to send the contractor a 1099 when the income is $600 or more). As far as I can tell, the new $600 rule is kind of just connecting the dots and making it harder to ignore the tax responsibility when the money is transferred through apps like Venmo. I agree it’s not a great thing to focus on when the wealthy are not paying their fair share of taxes, but it’s also not a huge change.