Isn’t the gist of Bidenomics just “fuck China, give companies more power”?

Biden’s policies are a radical non-break from Trump’s and it’s crazy to me how there isn’t more hay made about that

Still waiting for Biden to revoke the Trump tax cuts for the rich …

Nothing will fundamentally change, Jack

This only represents people with bank accounts doesn’t it? No way the bottom quartile overall has an average higher than a grand

Honestly, even 10k isn’t a large enough safety net in case something goes really wrong

if you measure it before rent is due maybe

when I was poor I struggled to have non-0 savings. I have a graph of my savings from the last decade. I was really excited when I could sometimes get it to nearly $500 before it crashed to zero

I’m doing better now. I hope I never forget where I came from

Never forget. Never forgive.

It is median. So it tracks the 12.5%th poorest American. Only people with bank accounts apply.

Republicans believe in strict racial supremacy, where if you are white and religious you are a good person.

Democrats believe in strict meritocratic hierarchy, where if you are succeeding and speak corporate you are a good person.

There needs to be two pro wrestlers who are always at each other’s throats. One wears a big neck chain with a huge cross. The other wears a lanyard with a use security card. And they are both heels.

“I don’t know why you’re complaining,” I say to my fellow scavenger as I pull a shabby jacket off a frozen corpse in the alley behind an abandoned Applebee’s, “the economy is doing great!”

What’s worse, I had to finance my FUCKING DENTAL PLAN… AND HAVE TO GET A CREDIT CARD

We went to Mexico for dental work

Do they give out knock out pills and just keep my mouth open? Cause I SUCK at the dentist

I’m not better off when I make $1 more an hour but gasoline costs $2 more a gallon and I still don’t make enough with my entire fucking paycheck to afford an apartment

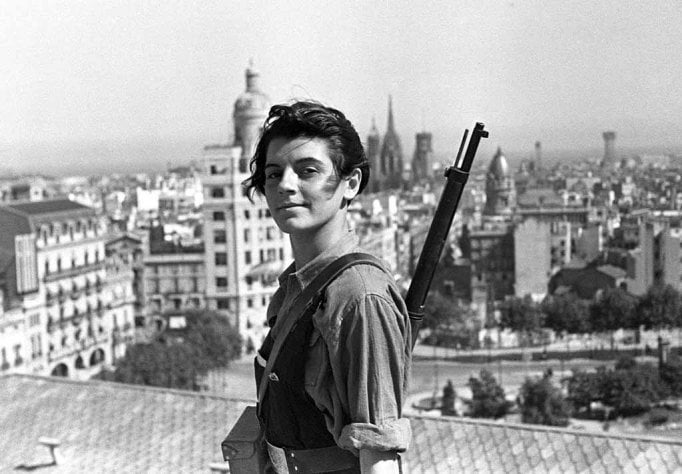

I’m still trying to understand this graph, here’s how I look at it right now.

Please do correct me if I’m wrong.

the different lines refer to quartiles or 25% of the population? where the 1st line from the bottom is the poorest (0-24.999%), then 25% - 49.999%, 50% - 74.999%, and the top is the wealthiest at 75% - 100%.

Left is Median Money at Jan. 2020, then Jan. 2021 (Biden inaguration?), finally Jan.2023 at the end.

And the trend is, all classes of people had an increase if comparing Jan. 2020 vs Jan. 2023.

But it’s actually decreasing if looking at Jan. 2021 vs Jan. 2023?

Yes. People judge their circumstances in terms of relativity compared to their most recent circumstances.

deleted by creator

OHHHHH HE’S TALKING ABOUT THE VERTICAL LINES

I don’t understand, what should I be looking at? How do I interpret this?

The short answer is Americans are fucked. The slightly longer: While there may be a slight improvement in savings from 2020 to 2023, there was a point where people were trending upwards in savings before it took a dive down and stagnated, which people both will notice and rightly be upset with. This fact is more significant to the population.

That is, being “I got up to 3k in my savings two years ago and thought I was finally getting ahead and now it’s down to 2.2k because of life.” Is more meaningful to a person than “Well three years ago you had 2k and now you have 2.2k after those three years of trying to save, you’re doing better, guys, better appreciate Biden’s economy”

Or: losing 800 dollars over 2 years means more to a person’s psyche than gaining 200 over 3 years.

I had to look back at the graph after the explanations so here’s the shortest version

-

“politicians say it’s good you’ve gone from the left line to the right line - an increase in nearly $1000 on average”

-

“they ignore line 2 in the middle which shows that people went up more than twice as much before coming down again to nearly where they were before”

-

so while it’s true to say there’s been an increase, it’s equally true to say there has been a massive decrease too.

-

people who actually have to live like this won’t find it helpful to make a comparison to when they had slightly less money when there was a more recent time that they had a lot more money

-

It’s personal banking balances. The focus is on three points: January 2020, January 2021, and January 2023.

#2 is Biden’s inauguration.Edit… The very annoying lib pointed that out to me that #2 is the enactment of the “American Rescue Act of 2021” in March, 2021.Any economist can look at the vertical line of #1 and #3 but entirely skip #2 and say “There’s been an increase from 2020 to 2023.” A huge problem in economics is that many of economists never speak to typical people and they especially avoid poor people. Their heads are only filled with numbers and data.

They often act like typical people are morons who don’t know anything and don’t understand anything. They are smug when polling shows many Americans feel worse off. But people are concerned about the fall from #2 to #3.

Of course - economics colors the media and politics. Pundit brain and DC brain etc are similar to economist brain. Biden and his team come out with PR that “Bidenomics is working!” without understanding how typical Americans will view their rose-colored perspective. Democrats are flummoxed why people don’t get it.

This is all very predictable yet it happens all the time

#2 is not Biden’s inauguration. 2 is in march 2021, the enactment of Biden’s American Rescue Act of 2021, which gave eligible households 1400-2800 dollars. Which coincidentally is the size of the sudden uptick at line 2.

Oh joy, they gave means tested checks to a tiny fraction of households which are mostly not the most vulnerable people. And we are supposed to celebrate that?

I’ve ignored all the Lemmy drama except when it comes directly to my threads and lectures me.

Fuck off, asshole.

Wait so someone corrects you on a fact, not even providing his own opinion on said fact. Just simply stating a correction. And that is what is wrong with lemmy?

You might want to start your own non-federated echo chamber…

not even providing his own opinion on said fact.

I was of two minds about making an edit.

-

If I don’t make the edit - it bothers me.

-

If I do make the edit - some new fuckers might bother me.

And here you are! Fucking clockwork. As if you libs didn’t already have a million places to be annoying. Fuck off back to reddit.

Hey you could have just made the edit, doesn’t make your point any worse. And I would have never responded.

But no, you have to resort back to personal insults, even assume that everyone that talks back is “one of them libs”. At some point you might realise that not the story you are trying to tell is causing people to talk back, but your personality. But it looks like you aren’t quite there yet.

You came in here and expected civility in the face of your lib shit. I’m sorry but you brought this on yourself.

-

Yes. Duh. Witch is why people feel like the economy sucks now. Maybe should have done better since line 2 eh?

Yeah I had to look at this at least 4 or 5 times before I understood it lol

/r/dataisugly

Is there an extension of this graph? It’d be interesting to see what it would look like from let’s say 2010 or something.

kinda blows my mind that the highest quartile doesn’t keep more liquid cash, especially with as high as interest rates are.

the PF recommend is 3-6 months of income in a quickly accessible emergency fund. and that doesn’t include like savings for goals (weddings, vacations, etc) or housing projects or whatever, which sure as shit rich people do.

admittedly, when I do talk to high income people about finances and stuff, I often get the impression they play it real loose, don’t really have savings strategies, carry CC balances and do dumb shit like tap HELOCs for non-emergency shit. but I just thought that was because most of the high income people I know are fools, not that they were a representative sample.

I don’t think the recommendation of “3-6 months of income in a quickly accessible emergency fund” scales well. If you don’t make much and could need to buy another beater car after your current one inevitably dies, sure. But if you make significantly more, to the point where you max out your retirement accounts, what’s wrong with using a brokerage account for savings? I can have that money ready to spend in 7 business days and can use my credit card and checking account in the meantime. Yeah, risk, blah-blah-blah, but going with a guaranteed almost-zero is a suckers’ game while the line is still generally going up.

brokerage go up and down. meanwhile, HYSAs are around 5% and if the deposit is big enough, there are CDs even with near zero penalty for early withdrawal. it’s not recommended to keep an emergency fund in any vehicle which can go down, because usually line go down comes with widespread job loss,.like in '07

the point of the fund at that level isn’t replacing an unreliable car. those people drive nice cars with warranties and insurance. for someone pulling down $150k, needing a new car is barely a problem. the fund is for actual cataatrophe. generally, it’s for losing a job and being able to float for 90+ days, stay current on all loans, and keep the family on COBRA and the same network while they decide how to shift benefits around and be somewhat selective about the next job, instead of having to take whatever comes.

Sorry, I wasn’t aware of HYSAs until now; I was speaking based on the bad rates I was seeing when I decided not to mess with savings accounts anymore. Thanks for the info.

dont forget that a lot of people who get fat account numbers slap the reset button by dumping all of it into a down payment on a house

I just thought that was because most of the high income people I know are fools, not that they were a representative sample

well from my personal experience, i’d say they probably are a representative sample. The world is run by complete clowns and we’re beginning to see the consequences.

Notwithstanding the implication here, talking about the median of a quartile is very funny to me.

I wish covid 2 would happen so i can have a better financial situation again.

Please. I’m not asking for much.

Don’t worry it’s coming

Money printer go brrrrr

Biden’s top accomplishment is to have made it look like the fed stopped printing. L. O. L.

I am not even a line on the graph.

The uptick at line 2 is the enactment of the “American Rescue Act of 2021” in march 2021, where people were eligible to receive 1400-2800 dollars, depending on their household. And look at that, the uptick at line 2 is exactly the same size!

This is not a coincidence.

Just before, in Jan 21 when Biden was inaugurated, we see that savings had already been decreasing since the last Covid stimulus packages. They reached a low just before line 2, and were then boosted by Bidens Rescue Act. Since then, the economy has struggled to recover from Covid, and at line 3 we see that most Americans have burned through the extra savings that they got thanks to Biden. Luckily, that line has also been going down less (and it is inflation-adjusted as well), suggesting that the economy is actually slowly improving, as economic growth starts catching up with inflation.

It’s hard to overstate the impact of Covid on the global economy. To think that the effects can be magically handwaved away with some magic economic policy is just delusional. It was always going to take time.

Biden is far from perfect. But to claim these numbers show a poor performance from Bidenomics, when the numbers clearly show that his policies have allowed people to keep their heads above the water while the economy recovers, is just arguing in poor faith.

What they shows is that the majority of people are losing their savings, and that their savings is basically enough to cover a couple of emergencies, but not any other particular catastrophe. This is essentially looking the credit agencies right in the mouth here.

I mean it’s fine if you are generally ok with nobody below 85% of the population having any money, but expecting people to be happy or excited about these economic policies is simply delusional.

The wealthy 1% made more than 42 trillion dollars since 2020, nearly 2/3rds of all new wealth generated, with most food and energy corporations in the U.S. doubling their profits. The ‘economy’ isn’t struggling, it is people who are struggling, the average global and American worker, while these industries get bailouts and ‘loans’ (bailouts by another name), none of which gets shuffled down the value chain to labor, and any that does immediately gets hoovered up again by corporations testing their price/demand curve on essentials in a ‘crisis’.

Idk if it’s going to be enough to make him lose an election, but pretending people aren’t upset and don’t have a good reason to be upset is missing the forest for the trees.

If anything, it is a sign that there can be no more value given to the American proletariat in this system, we are completely stuck where we are in these ratios as an economy under this model of economic governance.

No it isn’t